Entrepreneurial finance for fast-growing start-ups: bootstrap & secure bridge financing. Venture Capitalists may help.

Thanks to this very blog, a Chicago-based young engineer & entrepreneur Skyped me yesterday. John thought I was a VC. Well, I´m a trainee in a capital and business development company - that´s slightly different in terms of decision-making power)); though I´m learning a lot.

John is a pure geek, in his own saying. We had a great conversation: I was happy to give him advice, and I hope John found some of it useful.

A fantastic programmer, John gives a damn about operations, finance and marketing. He´s been developing a software that suits the needs of many US & Chinese Universities (John´s family lives in China and is connected to the academic world over there). Anticipating his future need for manufacturing the software (every client University might purchase several hundred licenses), John attended a lecture about bridge financing last week.

- I asked: "How interesting was it?"

- "Probably great, but I still don´t understand what bridge financing is, so I didn´t get the most of it", John replied. "Anyways, considering the high-growth potential of my software company, I don´t need external financing. I don´t want VCs to come onboard and bother me with tons of questions I can´t answer. I prefer to focus on coding perfectly and taking care of clients."

Focus on quality and clients: fantastic attitude!

I praised his words, but told him firstly that growing and making sure cash inflow streams were increasing were two totally different businesses. Especially with clients such as Universities - not considered as fast payers.

Secondly, VCs can be extremely helpful to him. Venture Capitalists are not only boring financiers aiming at cashing out on your back. Some of them are real entrepreneurs, and true, VCs are finance guys, but good VCs get hands-on involved in the business strategy. Furthermore, considering John´s lack of business management experience, VCs could also provide free top-notch consulting on how John´s software company should be scaled.

I tried to make my point about growth and lack of funding resources using two examples, one of them I faced myself taking part of an entrepreneurial adventure in Israel one year ago. I thought what I told John, plus the two examples I used, might be of some help to the numerous geeks that frequently visit IT Addict (I wish...).

1) What bridge financing is

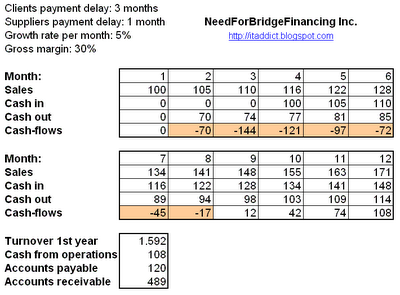

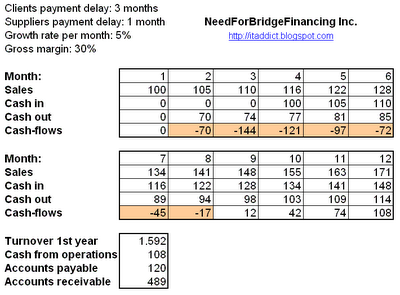

NeedForBridgeFinancing Inc. is a start-up company. Its founder was able to bootstrap in order to get the product R&D, suppliers sourcing and primary business development achieved. Therefore, these bootstrapping financial efforts are considered to be sunk costs.

The entrepreneur came up with a very successful business model. Transformations from primary goods aren´t costly (though the gross margin amounts to 30%), but the value added to the end-user is sound & real. The business plan reveals sales should increase by 5% every month, which is tremendous.

All in all, it´s pretty clear that we´re talking here about a very profitable venture. However, it seems obvious that prior to actually going into business for good, the entrepreneurial team needs to secure an 8-months bridge financing in order to survive its profitable fast-growth (which is often the case in high-tech start-ups) until breaking even. Bridging is a treasury management vehicle, usually a mezzanine loan, devised to help companies finance their net working capital. In the beginning of its operations, a company is just not scaled enough on the competitive landscape to decide how long supplier debts and customer credits should be cleared.

2) Venture Capital as a necessary financing step for entrepreneurial Gazelles

The term Gazelles usually refers to start-up companies, often in the high-tech sector, growing extremely fast. The first time I heard that word was during a lecture on entrepreneurial innovation clusters in the Netherlands: Erik Stam, an at the time bright Ph.D. student and now a Professor at Cambridge University, was letting his students at Rotterdam School of Management know more about his findings on the geography of gazelles in the Netherlands (see .pdf article). In France for instance, "Gazelle" is a label granted to the 2000 fastest-growing companies during two consecutive years. As an example, Photoways, the company ran by the French blogger and entrepreneur Michel de Guilhermier, was accredited "Gazelle" by the French SMEs Minister Renaud Dutreil recently (see post on Michel´s blog - in French, one of the blogs I visit most frequently for the top quality of its writer thoughts).

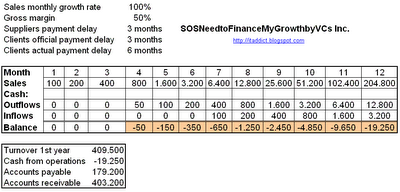

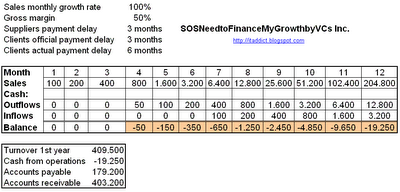

Well, let´s go back to our second example. The company we´re talking about in this case study definitely deserves the "gazelle" title: its sales grow 100% every month! Unfortunately, its competitive position is rather weak; although its management secured identical payment delays for both suppliers and clients, clients get pretty loose and the executive management of the start-up has no other choice, commercially speaking, than letting them do so - until its competitive bargaining power increases.

Fortunately, the entrepreneurial team had anticipated this situation, thanks to their talks with VCs (one of the VCs was an entrepreneur in the same business, prior to his exit after which he became a VC). So the VCs invested in this business, for the sake of all. Without the capital provided by the professional investors, the entrepreneurs´own financial resources could never have shadowed the development pace of the company in a sustainable way. After one year of operations and though the business model clearly shows profitability, breakeven is yet to come.

John might well have suffered a similar situation hadn´t he realized he needed to surround himself with skilled stakeholders: a team devised to support the software start-up´s scalability (John plans 3-digits growth in the American and Chinese educational market), and proper advisors with established networks and access to capital for the very best projects, such as John´s software start-up. I wish John good luck, success, and..fun!

John is a pure geek, in his own saying. We had a great conversation: I was happy to give him advice, and I hope John found some of it useful.

A fantastic programmer, John gives a damn about operations, finance and marketing. He´s been developing a software that suits the needs of many US & Chinese Universities (John´s family lives in China and is connected to the academic world over there). Anticipating his future need for manufacturing the software (every client University might purchase several hundred licenses), John attended a lecture about bridge financing last week.

- I asked: "How interesting was it?"

- "Probably great, but I still don´t understand what bridge financing is, so I didn´t get the most of it", John replied. "Anyways, considering the high-growth potential of my software company, I don´t need external financing. I don´t want VCs to come onboard and bother me with tons of questions I can´t answer. I prefer to focus on coding perfectly and taking care of clients."

Focus on quality and clients: fantastic attitude!

I praised his words, but told him firstly that growing and making sure cash inflow streams were increasing were two totally different businesses. Especially with clients such as Universities - not considered as fast payers.

Secondly, VCs can be extremely helpful to him. Venture Capitalists are not only boring financiers aiming at cashing out on your back. Some of them are real entrepreneurs, and true, VCs are finance guys, but good VCs get hands-on involved in the business strategy. Furthermore, considering John´s lack of business management experience, VCs could also provide free top-notch consulting on how John´s software company should be scaled.

I tried to make my point about growth and lack of funding resources using two examples, one of them I faced myself taking part of an entrepreneurial adventure in Israel one year ago. I thought what I told John, plus the two examples I used, might be of some help to the numerous geeks that frequently visit IT Addict (I wish...).

1) What bridge financing is

NeedForBridgeFinancing Inc. is a start-up company. Its founder was able to bootstrap in order to get the product R&D, suppliers sourcing and primary business development achieved. Therefore, these bootstrapping financial efforts are considered to be sunk costs.

The entrepreneur came up with a very successful business model. Transformations from primary goods aren´t costly (though the gross margin amounts to 30%), but the value added to the end-user is sound & real. The business plan reveals sales should increase by 5% every month, which is tremendous.

All in all, it´s pretty clear that we´re talking here about a very profitable venture. However, it seems obvious that prior to actually going into business for good, the entrepreneurial team needs to secure an 8-months bridge financing in order to survive its profitable fast-growth (which is often the case in high-tech start-ups) until breaking even. Bridging is a treasury management vehicle, usually a mezzanine loan, devised to help companies finance their net working capital. In the beginning of its operations, a company is just not scaled enough on the competitive landscape to decide how long supplier debts and customer credits should be cleared.

2) Venture Capital as a necessary financing step for entrepreneurial Gazelles

The term Gazelles usually refers to start-up companies, often in the high-tech sector, growing extremely fast. The first time I heard that word was during a lecture on entrepreneurial innovation clusters in the Netherlands: Erik Stam, an at the time bright Ph.D. student and now a Professor at Cambridge University, was letting his students at Rotterdam School of Management know more about his findings on the geography of gazelles in the Netherlands (see .pdf article). In France for instance, "Gazelle" is a label granted to the 2000 fastest-growing companies during two consecutive years. As an example, Photoways, the company ran by the French blogger and entrepreneur Michel de Guilhermier, was accredited "Gazelle" by the French SMEs Minister Renaud Dutreil recently (see post on Michel´s blog - in French, one of the blogs I visit most frequently for the top quality of its writer thoughts).

Well, let´s go back to our second example. The company we´re talking about in this case study definitely deserves the "gazelle" title: its sales grow 100% every month! Unfortunately, its competitive position is rather weak; although its management secured identical payment delays for both suppliers and clients, clients get pretty loose and the executive management of the start-up has no other choice, commercially speaking, than letting them do so - until its competitive bargaining power increases.

Fortunately, the entrepreneurial team had anticipated this situation, thanks to their talks with VCs (one of the VCs was an entrepreneur in the same business, prior to his exit after which he became a VC). So the VCs invested in this business, for the sake of all. Without the capital provided by the professional investors, the entrepreneurs´own financial resources could never have shadowed the development pace of the company in a sustainable way. After one year of operations and though the business model clearly shows profitability, breakeven is yet to come.

John might well have suffered a similar situation hadn´t he realized he needed to surround himself with skilled stakeholders: a team devised to support the software start-up´s scalability (John plans 3-digits growth in the American and Chinese educational market), and proper advisors with established networks and access to capital for the very best projects, such as John´s software start-up. I wish John good luck, success, and..fun!

4 Comments:

discovered three days ago, thanks to mdg :-) and allready addicted to your blog....

thanks for improving my communication skills

i'd like to speak about my project with you... any mail adress? not looking for money ;-o)

your web site adress is really "capricious" . it works sometimes when it wants. i know you're not the one to blame...

have a nice we

By Anonymous, at 7/21/2006 08:47:00 PM

Anonymous, at 7/21/2006 08:47:00 PM

Many thanks to mdg indeed, and for your compliments. Here´s my e-mail address: jeremy dot fain at mailhec dot net. No space nowhere, small caps work better.

Sorry for the inconveniences Blogspot creates. It´s a good service, but you´re right, it lacks connection bandwidth.

I´d be glad to talk with you about you projects. Feel free to contact me anytime.

Jeremy

By Jeremy Fain, at 7/22/2006 09:28:00 PM

Jeremy Fain, at 7/22/2006 09:28:00 PM

That´s right Jedi, you´re far away from entrepreneurial finance. Let me however answer your questions:

- About the Nielsen survey, look at my preceding post: figures about podcasting in the US are included in the report, but I just chose to emphasize on another issue the study was raising;

- Google v. Yahoo!: in my opinion, there´s no fight between the two Internet giants, whatsoever; on the one hand, Yahoo! has become a pure content company: it´s a media, and its stock chart behaves like media companies. On the other hand, Google is still a search engine (sophisticated mathematical search algorithms), but most, not to say all, of its revenues are derived from advertising. Hence my stance that Google is nothing else but an advertising company. Google is by the way more and more becoming a software on-demand company, launching all kind of Beta version services every month;

- about online video, I´m not an expert and I´m currently learning on the subject. I´d be glad to get to read your study.

You´re participating, that´s right, though not elaborating on the "Entrepreneurial Finance" topic. Maybe our fellow "financiers" from the Bungalow XVIII dream team (namely Frédéric J. from M.L., Alexis B. from S.-A., Manu P.-D. from E., and Claude de R. from U.) could post interesting and challenging comments? Would you dare send them an e-mail about their potential positive contribution?

Looking forward to their comments and reading your video podcasting article...

Warm regards,

Jeremy

By Jeremy Fain, at 7/24/2006 05:21:00 PM

Jeremy Fain, at 7/24/2006 05:21:00 PM

Hey Jedi,

I can´t correct comments, just erase them. But I was obviously talking about Bungalow XIII - the most prestigious secret rowing society in Europe.

Sorry for mis-spelling. I hope you´re all set and that a hord of financiers will soon be commenting on the initial post.

By Jeremy Fain, at 7/24/2006 06:51:00 PM

Jeremy Fain, at 7/24/2006 06:51:00 PM

Post a Comment

<< Home